Episode 4. Becoming an Intern at IBK, a Leading Korean Bank!

Starting in June, I prepared for interviews and studied finance in order to secure an internship in the financial sector. When I was writing my application, I made sure to include all of my experiences and career background without leaving anything out. I applied to two banks—IBK (Industrial Bank of Korea) and Hana Bank. Unfortunately, I was eliminated during the document screening for Hana Bank, but I successfully passed the first round at IBK and was invited to the second-round interview.

At the time I applied, around 6,000 people had applied for the summer internship program. Out of them, only 300 interns would be selected, and I was surprised by how competitive it was. Before preparing for this interview, I hadn’t realized that so many people wanted to work in the financial sector. Through this internship preparation, I came to understand for the first time that a large number of young people in Korea aspire to pursue stable careers.

The second-round interview consisted of two parts: a group interview and an individual interview. In the group interview, candidates were asked to debate a topic presented on the spot. The topic given to my group was the National Pension System, and I argued that the active use and expansion of private pensions could serve as an effective alternative to the challenges Korea faces with the national pension. I was able to gain the support of the majority of the group, which earned me a strong evaluation in this round.

The individual interview followed, where I answered both personal and general questions based on my résumé. Many of the questions focused on my experience in interpretation and protocol-related roles. In my responses, I emphasized key insights I had gained from those experiences, particularly highlighting customer management, communication, and service. I believed these qualities were especially relevant, since working in a bank involves directly engaging with customers and providing financial services, where strong communication skills and service experience are essential.

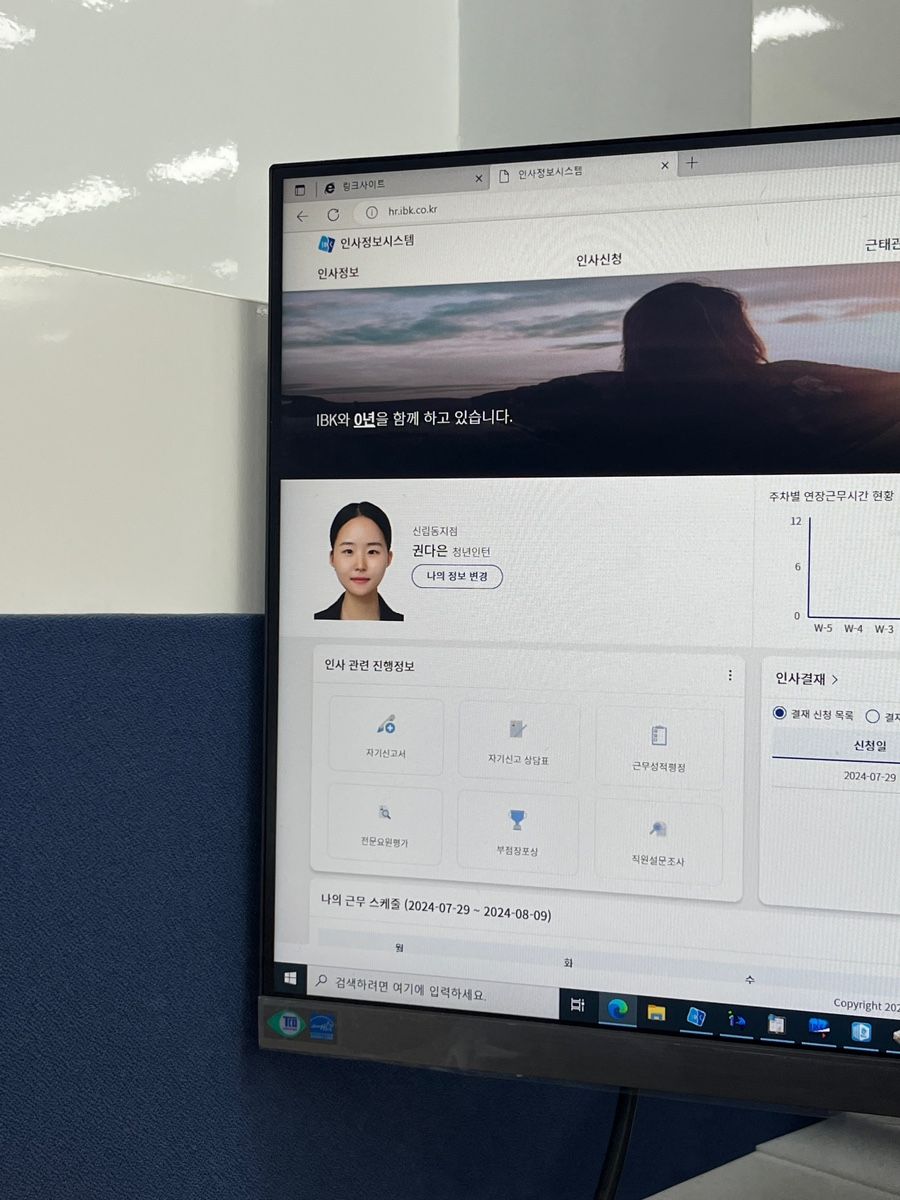

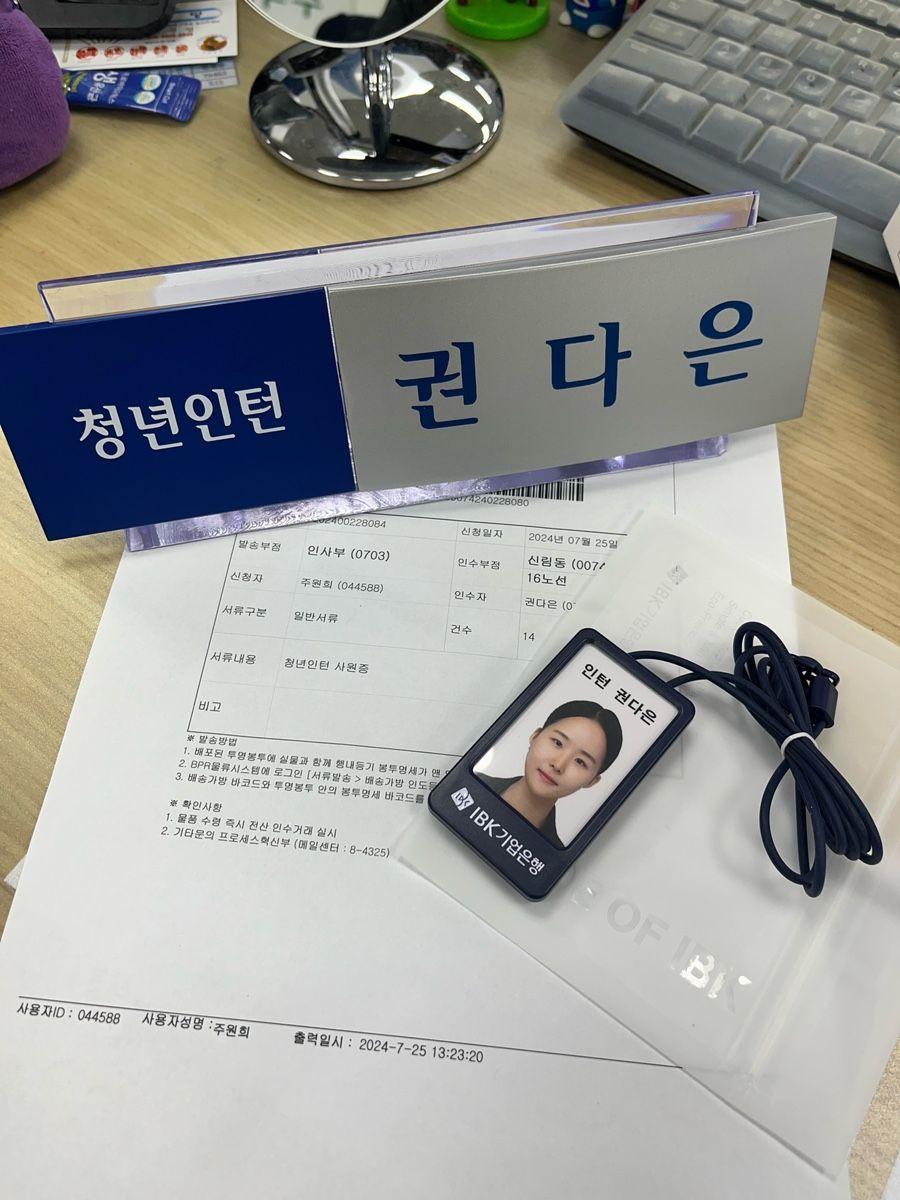

After the interview, I continued spending my time working in various part-time jobs, such as interpretation and project management roles. Then, in early July, I received the news that I had been accepted into the IBK internship program. Right after receiving the acceptance message, I began working, officially starting my internship. During the first week, I was registered in the HR system as an intern and issued an employee ID card. It was my second official employee ID, following the one I had received while working at the Secretariat of the Korea–Africa Summit, and I was truly delighted.

The branch where I was assigned had a relatively older customer base, which meant many people faced difficulties handling basic financial services. As a result, the branch had a constant flow of walk-in customers every day, keeping us very busy. At first, my responsibilities focused on assisting customers with tasks such as paying taxes online through digital kiosks and making smart transfers via mobile banking applications. Later, I was able to gain more in-depth experience with financial operations such as issuing bank cards, managing bankbooks, and handling BPR.

Among all my assignments, the most meaningful work was managing documents for real estate mortgage loans. I was responsible for reviewing and registering customers’ property documents in the system, checking for missing paperwork, and contacting clients when necessary. Through this, I was able to build substantial hands-on experience in financial operations and gain valuable insights into banking practices.

In the third week of the internship, we participated in a workshop held in Chungju, Korea. Early in the morning, we gathered in front of IBK’s headquarters and headed together to Chungju. The two-day workshop was packed with activities.

On the first day, we were divided into teams to practice group interviews and work on a startup project. Since most interviews in the Korean financial sector involve being given an unexpected finance-related topic on the spot and preparing a product plan or idea within a set time before presenting it, this workshop allowed us to simulate and practice that exact format. Later, we also had the opportunity to meet with startup companies selected by IBK. As a team, we worked on assignments to identify potential improvements for these startups and propose new product ideas they could consider developing.

On the second day, we attended sessions with representatives from IBK’s HR department, where we learned about the HR system, the bank’s desired talent profile, and useful tips related to recruitment. We also practiced team-based presentation interviews (PT interviews).

Overall, through this workshop program, I gained valuable experiences ranging from practicing financial-sector interview simulations to developing business proposals for startups. It was an intensive but rewarding opportunity to strengthen both my professional and practical skills.

During my five-week internship at IBK, I was able to gain the following insights:

First, when assisting customers, it is essential to view their inconveniences from their perspective rather than my own. Many elderly customers struggled with tasks that seemed very basic to us, such as digital banking or even passbook management, often finding it difficult to operate the machines or press the right buttons. While digital devices and banking services may feel second nature to us, they are not necessarily familiar to those who lived in a time before such technology was widespread. I realized that it is important to provide step-by-step support starting from the very basics, with patience and clarity.

Second, in order to learn and grow, I could not remain a passive employee. Both the branches and headquarters are extremely busy, so it is unrealistic to expect senior employees to always provide close guidance to interns. If I wanted to gain more experience, I had to actively think about how I could add value to the branch and take initiative by asking, “Is there anything I can help with?” This proactive approach opened doors for me to experience a wide range of tasks. For example, when I expressed my interest to the deputy branch manager in gaining more hands-on experience, I was encouraged to try out many different responsibilities—such as collecting signatures outside the branch, visiting other branches, and observing real banking operations.

Third, through presentation tasks (PT), I noticed the growing demand and interest across the financial sector in digitalization and AI-driven financial products. This trend is evident in the overall direction of the banking industry today. Therefore, for future interns preparing for interviews or product-planning presentations, I believe it would be advantageous to prepare ideas related to digital or AI-based financial product development, as this could increase their chances of success.

As the summer heat began to fade, my second internship came to an end. One of my goals for the year was to gain experience in the financial sector, and I felt proud to have accomplished it. More importantly, it was a meaningful time that allowed me to reflect on which career path and role might suit me best.

Most of the people I worked with during this internship have since gone on to secure positions in the financial industry, and I occasionally hear updates from them on Instagram. It’s always uplifting to see so much good news.

All in all, it was a summer filled with valuable insights and experiences that I will carry forward with me.